Initial Meeting and Analysis

We help you figure out exactly how a retirement plan might fit your business by:

- Asking you what you want, what you’re currently doing, and why

- Reviewing your existing arrangements (if any) to see if they’re good enough

- Why make major changes if an easy adjustment will do?

- Analyzing your goals and current situation

- Providing strategies and choices you can use to get what you want

- Guiding you and offering insight about which options may be appropriate

- Transparently disclosing the costs, risks, and tradeoffs

- If you want, we will also serve you on an ongoing basis after the analysis is complete

- But you don’t have to use our services, and in many cases you don’t have to change providers

Investments

What About Investments?

- We believe that participant behavior and a well-designed plan are the most important determinants of success.

- However, having a variety of investment options helps ensure the mechanisms are in place for a participant to align their choices to their goals.

- We are specially trained with a focus on asset management and fiduciary risk management.

- Our staff includes an AIFA, which you may not find in many offices.

- We help you make sure the investment selections are optimal for your employees by using advanced tools to evaluate fund performance.

Ongoing Service

What Can You Expect On An Ongoing Basis?

We hope you'll choose to work with us for the long term, and we promise:

- Trustee Meeting and formal review of the plan and investments at least annually

- Manage your fiduciary liability and make sure the plan is doing what it's supposed to do

- Ongoing education and enrollment meetings for employees

- Generally conducted by our local staff -- not a representative flown in by the investment provider

- We get to know you, and you get to know us

- One-on-one discussions with employees

- Regular updates as regulations change and the retirement plan marketplace evolves

- Benchmarking and comparisons to other plans

- Availability via phone, email, and in person if you ever have a question

- Employers (plan sponsors) and employees (participants) are always welcome to call

- Access to local experienced staff, including CFP practitioner and ChFC and AIFA

- Troubleshooting when you don't know who to ask or your other service providers aren't helping you

- You'll hear from us! We don't just wait for you to call

- We proactively reach out to schedule the events above

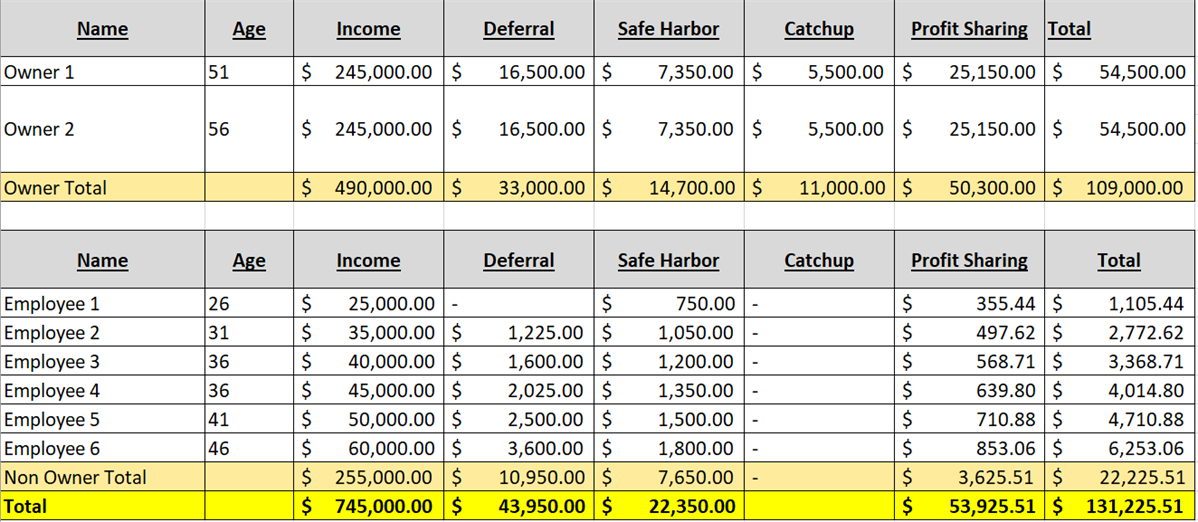

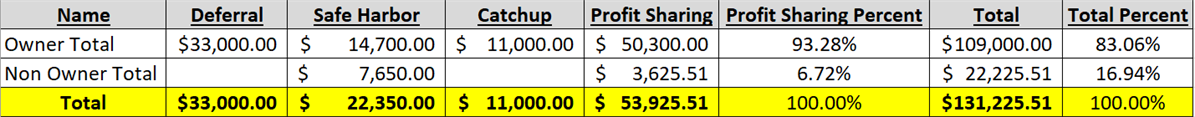

Sample Plan Design

A sophisticated plan design can maximize benefits to key personnel while keeping costs down.

When setup properly (and with the right employee profile), these plans can pass discrimination tests and reward key talent.

Note how owners in the example get to keep 93% of the profit sharing contribution.

The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results may be more or less than those shown. This does not represent any specific product [and/or service].